Want to know about the best money transfer agency? Check Out TransferWise Review Now

If you have a business setup or you’re a freelancer working remotely from your country then at some point you have made an international money transfer. Sending or receiving international payments costs us a few extra bucks in the form of transfer fees and exchange rates.

Some of the banks generally give customers an above-market rate and their margin is an actual part of their fees and particularly they are not apparent the hidden fees.

Most of the time banks and other transfer service providers add a markup right to their exchange rate while advertising low fees and manipulating us. Somehow we have to pay huge hidden charges while making international payments.

When it comes to exchanging rates, not all of the platforms offer equal exchanges.

We didn’t get the latest exchange rates whenever we make payments via banks and other transfer services like PayPal, Stripe, and others…

In these cases, we somehow lose some portion of our money without even noticing. So what’s the solution to this problem? Is there any platform available out there that doesn’t charge additional hidden fees and offers real-time exchange rates?

Yes, there is a platform that generally focuses on making bank transfers more simple and affordable than conventional banks simply by charging little and transparent transfer fees.

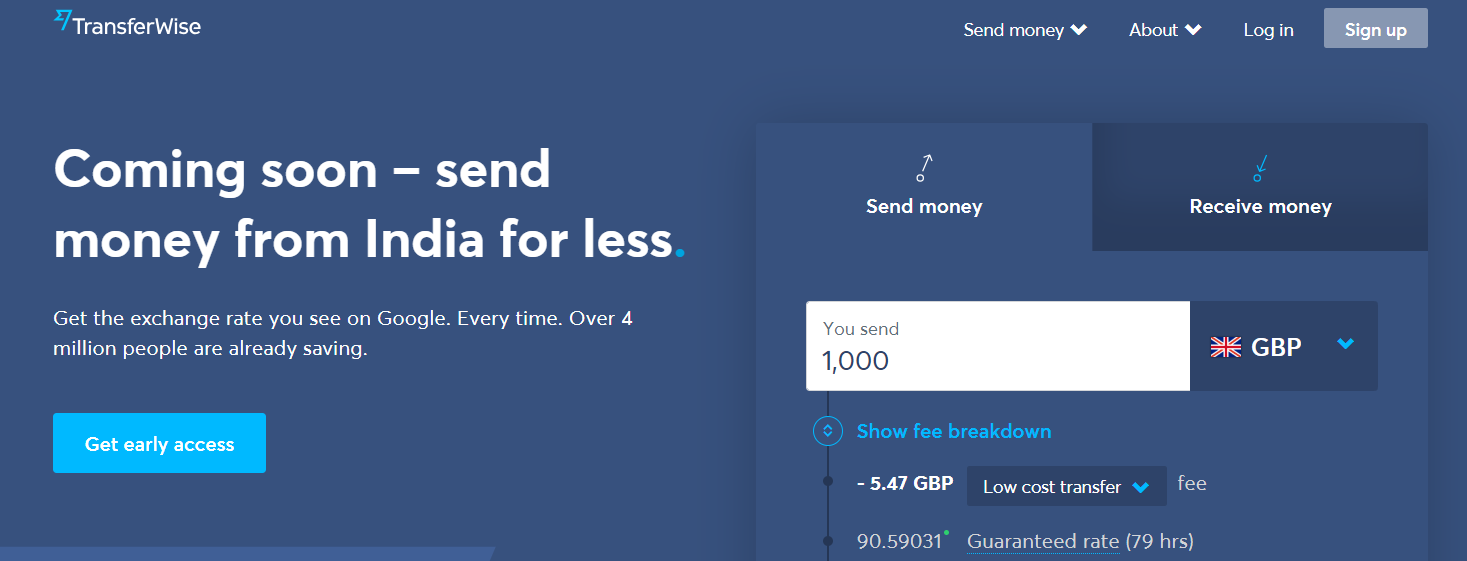

Here comes- TransferWise (An innovative international money transfer provider that charges low and transparent transfer fees.)

In this post, we have featured TransferWise Review 2025 that includes detailed insights about its features, functionality, supported currencies & countries, sign-up process, pros & cons, and more. Let’s get started here.

TransferWise Review 2025: A Reliable Money Transfer Platform

What Is TransferWise?

TransferWise is a UK-based company that makes international money transfer easy and conventional. TransferWise is the idea of two people named Kristo Käärmann and Taavet Hinrikus.

TransferWise mainly focuses on making bank transfers more conventional and accurate than other traditional banks.

It charges low and transparent transfer fees and also converts money at the true mid-market market exchange rates.

The best part about TransferWise is that it supports more than 71 countries and more. Another best part is that it covers more than 1000+ route country combinations right across 49 countries.

Most of the currencies supported by TransferWise mainly offer one option a bank transfer right from one bank to another. And here for some of the currencies, it offers the option to pay with other debit and credit cards or use another SOFORT transfer option.

The interesting part is that it also supports Apple Pay and Android Pay for certain currencies via the TransferWise iOS and Android apps. In most cases, the recipient will get the money right within one or two business days.

TransferWise is the top choice for international money transfers all over the world. They are well-known for providing great customer service and their review is featured on sites like Trustpilot.

Besides that, it provides speedy transfer along with a spectacular user experience.

The process of sending or transferring money is very simple and safe. TransferWise has seen massive growth since 2011 and till then they are grown exponentially.

It transparently shows its fees upfront and only deducts them during the conversion. And then it uses the mid-market rate that is independently by the Reuters right without any markup.

Also Read: Transferwise vs Western Union Comparison

TransferWise Features

Exchange Rate Locking:

When you use TransferWise to send money, here it will automatically lock the exchange for a specified amount of time.

Like for many of the countries, this is for 24 hours, and for several others, it’s locked for 42 hours, and right for BRL (Brazilian Reals) it is locked for 72 hours.

These features help in getting the real-time exchange rates for any currency. And this also ensures that you can get massive fluctuations in the exchange rate at the last minute.

TransferWise Business:

This feature is specially introduced for e-commerce businesses, here TransferWise offers you the flexibility to set up a TransferWise business account that allows you to receive payments from all over the world.

The best part about this is that here you can simply hold and then simply convert your money right into over 40 currencies. This feature gives you the flexibility to spend money anywhere in the world hassle-free.

This TransferWise business account opening needs several steps. In the starting, we need local bank account details that will allow us to receive payments in other major currencies like Euro, US Dollars, and UK pound as well.

And after that, you simply pass these bank details to your recipient which will help you in avoiding the high markups that you generally get with most international payments.

TransferWise Card:

As we have mentioned earlier you can create a business account and also you can easily apply for a TransferWise debit MasterCard. But this special feature is only available in some parts of the world like for European-based customers.

The best part is that TransferWise is going to introduce this feature in the United States. This feature is in Beta Stage currently and you can join a waiting list to sign up for one.

This TransferWise Debit Card allows you to spend money anywhere in the world at fixed and promised exchange rates.

The best part is that it is always free to play with any of the currencies you generally held within the account and if you wanted to convert it to a different currency then TransferWise offers a fantastic low conversion fee and it costs us zero transaction fees.

Another interesting thing about TransferWise Debit Card is that you can easily make a withdrawal of up to £200 a month at any ATM.

How Does TransferWise Work?

TransferWise currency exchange process has completely cut out the middleman. The best part is that it allowed them to charge significantly less than anyone else transfer service providers in the market.

TransferWise is a peer-to-peer (P2P) service that truly indicates that they generally match people who want to transfer one currency right into another one.

Like if we take the example here, if we want to swap money up to 1000 GBP into EUR, TransferWise will simply add your 1000 GBP to a pot of GBP and it will automatically send the equivalent amount (994.53 GBP) EUR right to receipt you have selected. This shows that you are not going to lose your money when you make any transfer.

TransferWise Security

You should know that TransferWise is not a bank but it is authorized and safely regulated by the FCA (Financial Conduct Authority) in the UK like many other banks out there.

TransferWise is authorized, secured, and regulated right under regulations enforced by FCA. It will hold all the funds from its customers separately from the money that they simply use to run their company.

The best part about TransferWise is that you will always know where your money is. Here you will be updated via email right at each stage of the transfer. And also TransferWise gives you the option to track your transfer with their amazing Mobile App and website whenever it is convenient for you.

TransferWise Customer Support

The support that you will be getting from TransferWise is very reliable. They offer a FAQs section that is properly optimized with many sections for every type of transfer and also the functionality of TransferWise.

Here you can also get the mid-market rate that I think all the providers don’t provide. And here if you do need to ask a question then you can easily live chat with the customer service representative.

Besides that if you somehow run into a downside you can simply reach customer service by phone from 8 am to 8 pm ET on weekdays. Overall it provides a great base of customer support that can help you in every way possible.

How To Sign Up With TransferWise For Making Payments?

The signing up process is straightforward to make the initial signing up process smooth they offer the option to sign up with Google or Facebook account.

Right before you begin you need to follow a very strict process to verify your identity to simply comply with anti-money laundering regulations and more. To simply get started with it you need to provide the following documents.

- Proof of Address: You need to provide a utility bill (phone, electricity, gas), credit card statement, tax bills, and many more things in a row.

- Identification Documents: National Id Card, Driver’s License, Passport.

Apart from those authentication processes, TransferWise will send you a text right with a security code and an email as well. Once you will complete this process is complete, you will be able to make your first transfer.

How Much Time Does It Take To Complete Any Transfer?

First of all, you need to finalize the amount that you wanted to transfer. Then as a bonus, you will see the estimate of when the amount will arrive and a few other details as well.

When you select the money you want to transfer TransferWise will show you the fees upfront and will only deduct them right before the conversion. And after that, it mainly uses the mid-market range without markup.

And best of all, the exchange is guaranteed as long as the TransferWise receives your money within 24 hours.

Quick Links:

- ePayments.Com

- Best WooCommerce Payment Gateways For WordPress

- Intuit QuickBooks Special Discount Coupon

- Arcadier Review

- ThriveCart vs CartFlows

- Best CartFlows Alternatives

Conclusion: TransferWise Review 2025

After using TransferWise without a second thought I would like to say it is one of the reliable and affordable platforms for sending money internationally. And best of all it offers you the real-time exchange rate for any currency.

TransferWise takes low transaction fees and offers great transparency for every transfer that you make.

And also this platform is completely reliable and secured as it is regulated by the FCA (Financial Conduct Authority) Bank of England.

Best of all TransferWise also provides a very useful Mobile-App that can help you in making payments in a single go without putting in that much effort.

If you’re a freelancer or online marketer you should give TransferWise a try. Feel free to tell us which transfer tool you use to make international payments right in the comment section below.

We hope this post suits your purpose well.

If you liked the post, feel free to share it with your friends and colleagues on all trending social media platforms so that they get know about this amazing transfer tool.